Authors: Barbara Lawrence and Katy Donlan

At the end of 2017, the most significant federal tax legislation to take effect in over three decades was enacted. Federal guidance issued over the past year regarding that legislation and favorable state tax law changes have converged to make 2019 one of the most favorable wealth transfer tax planning environments on record.

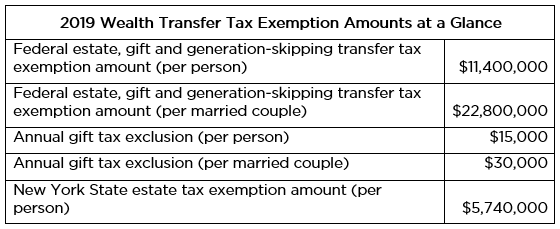

In addition to the increased exemption amounts shown above, taxable gifts made by a New York resident who dies on or after January 1, 2019 will not be subject to New York estate tax at the resident’s later death. (This is in contrast to prior law which included lifetime gifts made within three years of death in computing the New York taxable estate.) As a result, making a current gift provides an opportunity to lock in the benefit of the increased federal exemption while preserving the entire New York exemption.

The time to take advantage of the historically high federal exemption amounts is limited and there appears to be no risk in doing so. Under current law, federal exemption amounts are scheduled to return to 2017 levels on January 1, 2026. Additionally, future legislation could alter exemption amounts even earlier than 2026. Fortunately, proposed regulations issued in November 2018 provide that tax will not be imposed on gifts covered by the increased exemption even if it is later reduced before the donor’s death. These proposed regulations aim to prevent a “clawback” of the tax savings that can be achieved by making gifts under the currently high exemption amount.

For most wealthy clients, making gifts during this window of heightened exemption amounts presents an opportunity for millions of dollars in tax savings. For ultra-high net worth clients, these tax savings can be significantly compounded using wealth transfer tax planning techniques designed to leverage these exemption amounts.

For the charitably inclined, strategic planning may be required to maximize the tax savings potential of charitable gifts. Due to higher standard deduction amounts (for 2019, $12,200 for single taxpayers and $24,400 for married filing jointly taxpayers) and the limited deductibility of state and local taxes, additional tax savings may be achieved by donating in a single year the charitable contributions that would ordinarily be made over several years. Private foundations and donor advised funds can be used to hold the aggregated donations and distribute them to the ultimate charitable recipients over a period of years.

To determine how you and your family can best take advantage of the historic tax savings opportunities available this year, please contact one of the members of our Trusts and Estates Department listed below.